Economists and business leaders are warning that the Bangladesh Bank's (BB) lost autonomy is directly responsible for a host of major economic woes, including soaring bad debt, red-hot inflation, widespread illicit fund flows, and a recent uptick in the poverty rate.

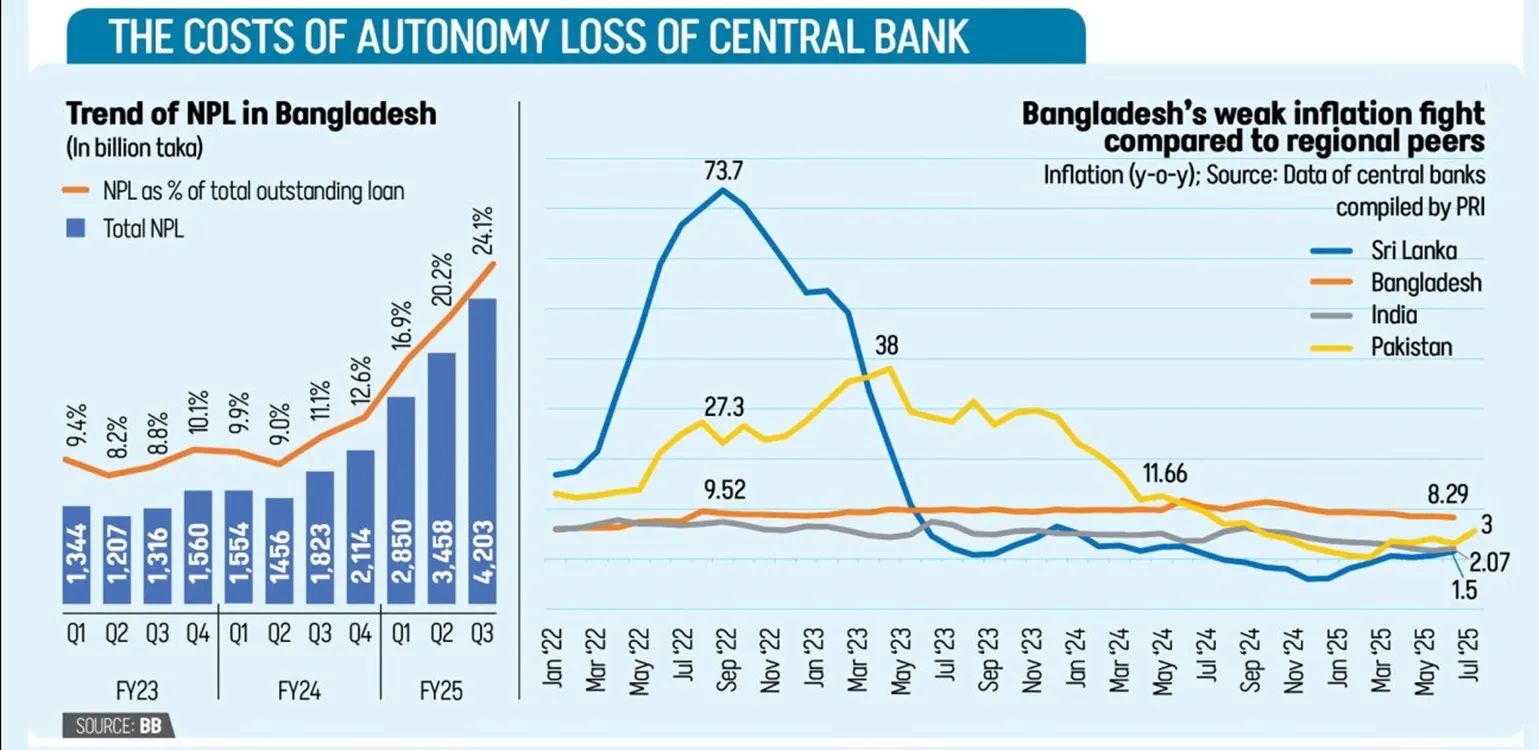

At a roundtable organized by the Policy Research Institute (PRI), a paper was presented claiming that regulatory leniency led non-performing loans to balloon to Tk 420,335 crore by March. Furthermore, inflation, which hit 11.66% last July, remains stubbornly high compared to neighbors, eroding real incomes.

The PRI report attributes the crisis to the outdated Bangladesh Bank Order-1972 and the establishment of the Financial Institutions Division under the Ministry of Finance, which, along with weak central bank leadership, has "severely curtailed" operational independence.

Think tanks and former ministers, including BNP's Amir Khosru Mahmud Chowdhury and CPD's Fahmida Khatun, agreed on the need for central bank autonomy.

However, they stressed that legislation alone isn't enough; appointments must prioritize competent and committed individuals, and broader financial sector reforms (like strengthening the capital market and abolishing the Banking Division) are essential to relieve pressure on the BB. Business leaders also called for greater policy consistency and an end to "high-powered money injection."

Comment