In the context of the decline in the price of pure gold in the local market, the Bangladesh Jewelers Association (BAJUS) has decided to reduce the price of precious metal gold in the country's market. According to the latest adjustment, gold is being sold at a lower price of Tk 2,216 per bhori across the country on Wednesday (February 18).

According to the new price, which came into effect from 10 am on Tuesday, consumers now have to pay Tk 2,58,824 to buy a good quality 22-carat gold bhori. This information was confirmed in a notification by the BAJUS Price Determination and Price Monitoring Standing Committee.

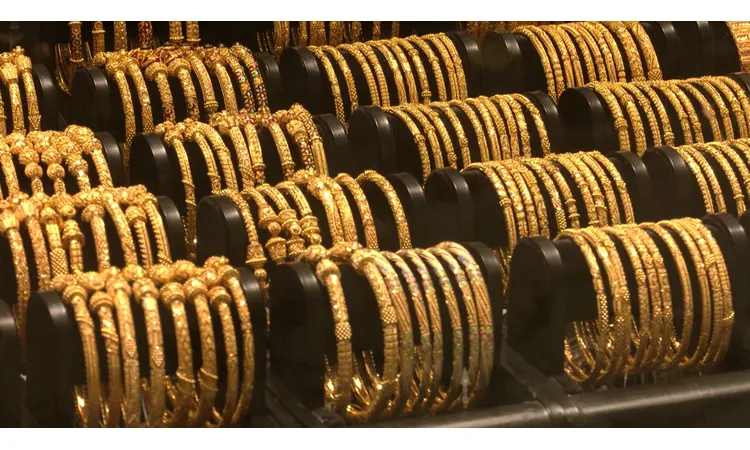

According to the newly fixed price list, 21-carat gold is now available for Tk 2,47,044 per bhori. In addition, the price of 18-carat gold has been fixed at Tk 2,11,760 and the traditional gold bhori is being sold for Tk 1,73,327. However, in the case of purchasing ornaments, the government must pay 5 percent VAT and the minimum wage of 6 percent set by BAJUS along with this price. However, the organization has clarified that the wage rate may vary according to the design and quality of the jewelry.

So far in the current year 2026, the price of gold has been adjusted 29 times in the country's market. Of these, the price was increased 18 times and reduced 11 times. Earlier, in 2025, there was widespread instability in the gold market, where the price was changed a total of 93 times throughout the year. Last year's statistics show that at that time the price was increased 64 times and reduced 29 times. The traders concerned believe that such frequent changes are happening due to global instability in the gold market and fluctuations in the price of acidic gold.

Despite major changes in the price of gold, the silver market is currently stable. According to BAJUS, a 22-carat piece of silver is currently being sold for 6,357 taka. Apart from this, the price of 21-carat silver remains unchanged at Tk 6,065, 18-carat at Tk 5,190 and traditional silver at Tk 3,907 per bhori. The price of silver has been adjusted 17 times in the silver market so far this year, including 10 increases and 7 decreases.