- National

- Bangladesh

- Business

- International

- Sports

- Entertainment

- Politics

- Technology

- Life Style

- Religion

- Opinion

Monday, 02 March 2026

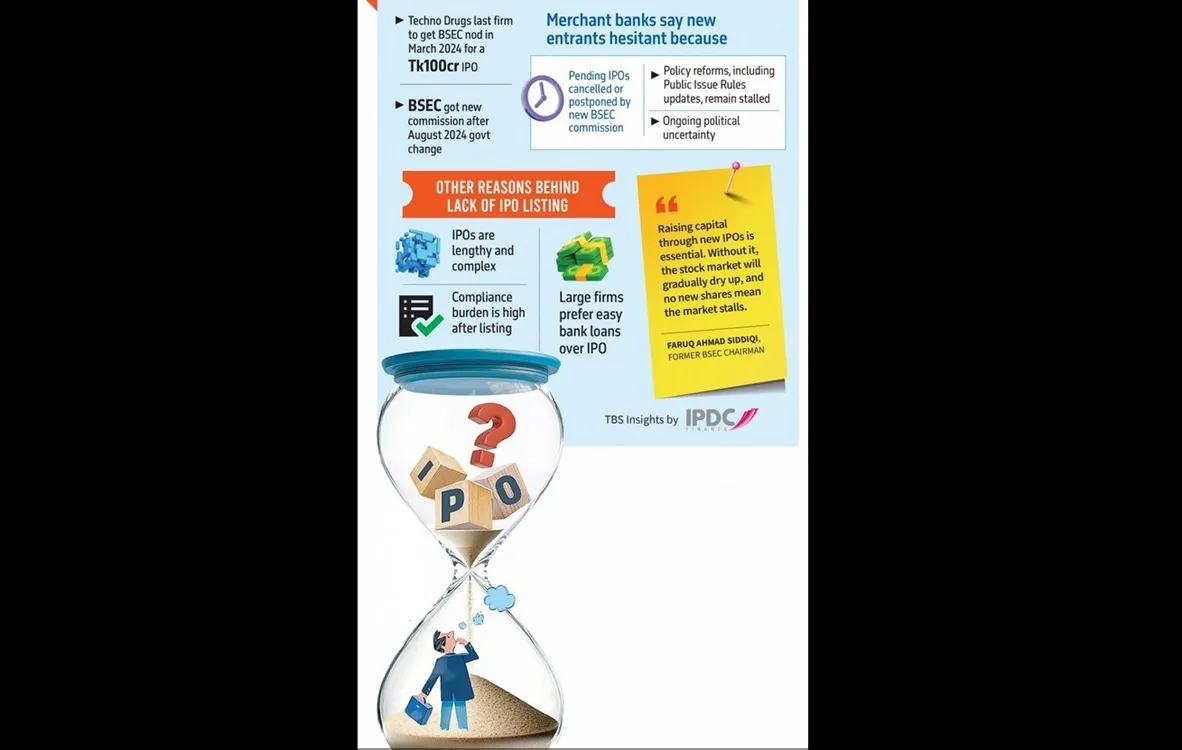

Bangladesh’s capital market is enduring its longest Initial Public Offering (IPO) dry spell in recent memory, with no new listings approved for over 18 months, despite clear directives from Chief Adviser Muhammad Yunus to revive the market.

The paralysis is rooted in a combination of corporate resistance, regulatory reform, and political uncertainty. Key factors contributing to the drought include, the new Bangladesh Securities and Exchange Commission (BSEC), under Chairman Khondoker Rashed Maqsood, canceled nearly a dozen pending IPOs as part of a reform drive, effectively emptying the market's supply pipeline.

Most of the Multinational companies (MNCs) have shown little interest in listing, stating they "don't see the need" to raise funds via the stock market. Private firms prefer bank loans, citing the lengthy, complex, 24-month IPO process in Bangladesh compared to 6–8 months internationally.

The Merchant bankers are hesitant to submit new applications, citing a market freeze caused by uncertainty over amendments to the Public Issue Rules. The BSEC is working on these reforms but has not yet published the draft for stakeholder feedback.

The government’s parallel initiative to bring 18 state-owned enterprises (SOEs) to the bourse has stalled completely, with no tangible progress.

While BSEC maintains that they have not received any new applications, market analysts stress that without a fresh supply of strong listings, the capital market will "gradually dry up," warning that the market is failing to reflect the clear signs of economic recovery forecast by institutions like the World Bank.

Comment