Foreign multinational banks in Bangladesh are facing criticism for their low Corporate Social Responsibility (CSR) spending, despite recording the highest profits in 2023.

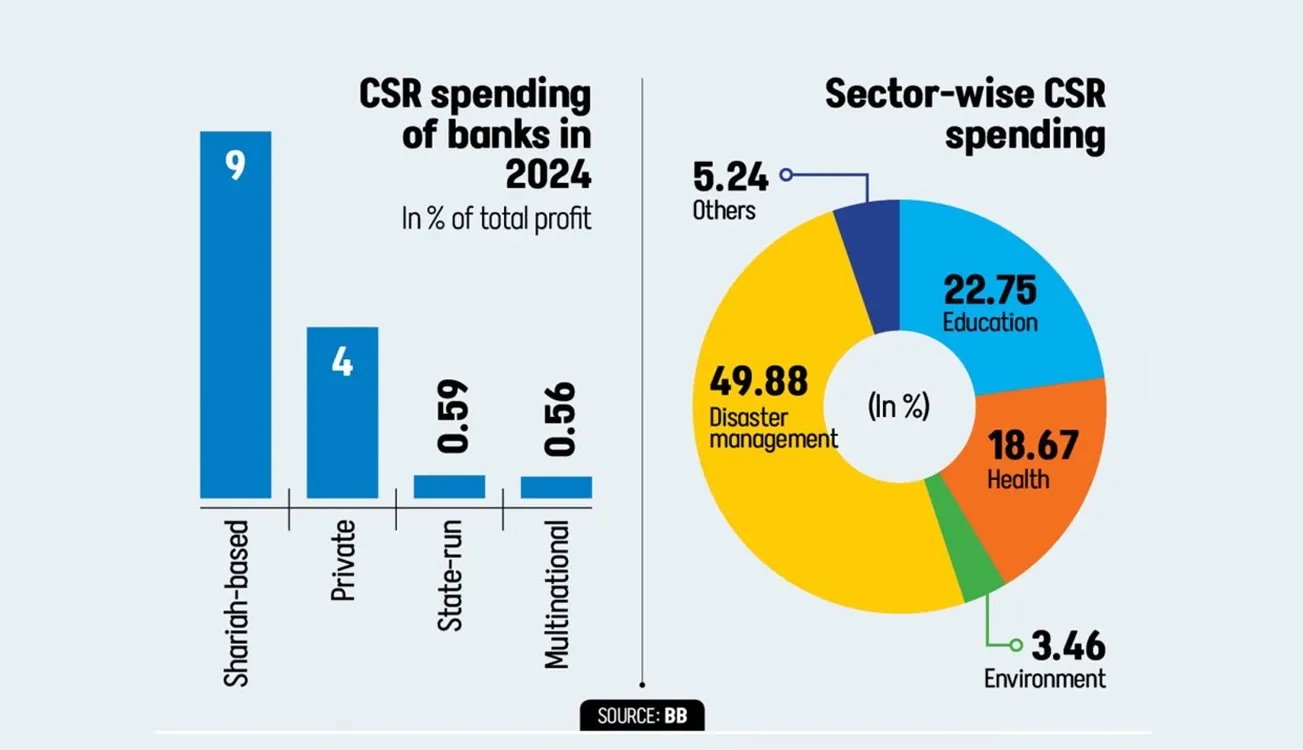

Foreign Banks, posted the highest collective profit (Tk 4,453 crore) but spent the least on CSR—just 0.56% (Tk 25 crore).

Islamic Banks, despite financial struggles, they led CSR contributions, spending about 9% of their Tk 2,658 crore profit.

Local Private Banks, ranked second, contributing 4.2%. State-Owned Lenders, Spent 0.59%.

Overall Trend, Total banking sector CSR spending fell by 33% in 2024 to a mere Tk 615 crore, marking a second consecutive annual decline.

Lenders like Standard Chartered and HSBC argue that the low percentages reported to Bangladesh Bank (BB) do not reflect their total social commitment. They state their approach prioritizes "impact over expenditure" and they fund projects through global programs and separate agricultural sector reports, which are not included in the main BB CSR data. For example, SCB reported over Tk 47 crore spent on the agricultural sector in 2023/2024 to a separate BB department, and HSBC highlighted its global water and education programs.

Banking experts argue that given the hefty profits, the central bank should urge foreign banks to increase their CSR contributions. They point to international examples like India, Indonesia, and Denmark, where CSR spending is mandatory or part of corporate governance, and suggest the BB should hold multinational banks more accountable.

Some analysts, like former BIBM director general Toufic Ahmad Choudhury, questioned the ethics of some financially troubled local banks spending heavily on CSR (up to 21% by Mercantile Bank) when they should prioritize protecting depositors. He also criticized the quality of CSR spending by local banks, noting it often lacks lasting impact and is sometimes linked to the board members' localities or done under "political pressure."

Comment