NBR chairman Mo. Abdur Rahman Khan said that the government has many big officials and employees whose salaries are taxable but they do not cut the tax. He said, "Yesterday I took data from the IBAS system how many of our government officials and employees cut the tax from their salaries. Under the Finance Act of 2014, we are required to deduct tax from the salaries of government officials and employees. Now that our salaries are in the IBAS system, it is very easy to track. I saw that a large number of employees in each ministry whose income is taxable but they do not pay taxes from their monthly salary.

Even a large number of employees of the NBR and IRD do not pay taxes. This is an example of how low-level the country's compliance labels are. The most conscious and important people of the country, they do not comply properly. It is very easy to combine.

I have given all the secretaries of the ministry. They should instigate the Accounts and Finance Officer so that they can be taxed. Taxes are very easy to pay. When they see that they have not cut the tax from the salary, they will not process the bill.

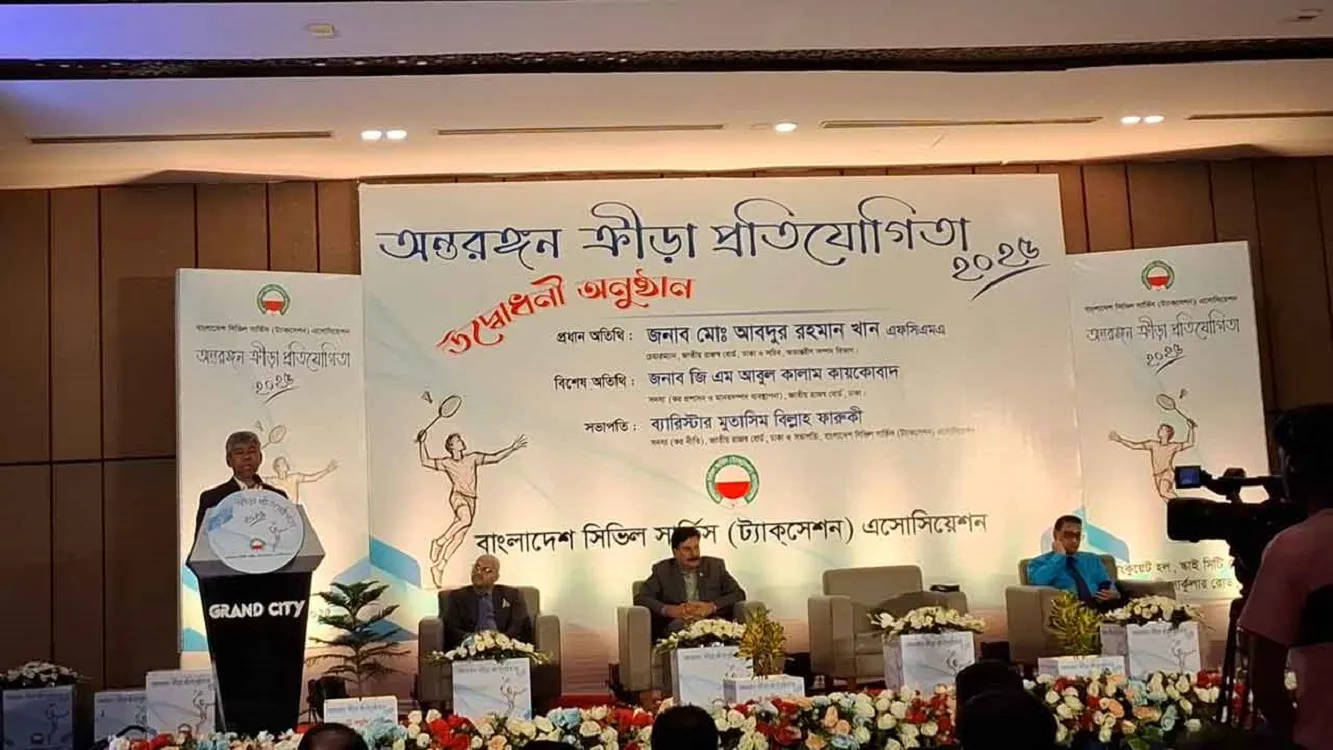

Addressing the income tax officials, the NBR chairman said the income tax family is a traditional family. We are all members of this family. There may be a distance between us on a number of issues. This distance can be created for a variety of reasons. One could be an information gap or an extension gap or a revenue income. That's why I'll learn from there. We want to start a new way of forgetting everything. Through this sport, a different relationship will be established with everyone. This will reduce the gap.

For example, the NBR chairman said, "Recently, we have issued a directive in all tax zones on how to increase intelligence activities in each zone. We have seen that the amount of intelligence that needs to be done is not able to do the amount of intelligence that the central intelligence cell and the income tax intelligence are capable of working. That is why we have to do intelligence in every area.

When we ask for a refund, we say that so many people don't have a tax. They are not available for various reasons. Why don't we de-register them? We have a duty to registration. When we say, the number of my TIN holders is one million 20 lakhs, and my return comes to 45 lakhs, it is unacceptable. TIN holders may have to undergo de-registration, which is not available. Or you have to tell them why you don't return.

Comment